YouTube Mega-Influencer MrBeast Eyes Financial Services for Gen Z

Jimmy Donaldson better known as MrBeast, appears ready to trade in viral challenges for checking accounts.

According to recent filings and industry reports, the 27-year-old YouTube star has registered the trademark “MrBeast Financial”, a name suggesting ambitions that extend deep into the financial sector.

Documents detail plans for a mobile platform offering features like banking, savings, lending, insurance, and even crypto exchange capabilities.

The filing, coupled with supporting investor materials, points toward a full-stack fintech venture aimed squarely at MrBeast’s digital-native audience.

The pivot follows years of expanding beyond content creation into burgers, snacks, and philanthropy.

Financial services, however, represent his most regulated and complex leap yet, one that could redefine how influencers leverage their fanbases for brand-built ecosystems rather than sponsorships.

Why Gen Z and Why Now

MrBeast’s fanbase is overwhelmingly Gen Z, a demographic that tends to trust creators more than institutions. This makes the financial space both a high-risk and high-reward frontier.

Younger consumers increasingly rely on creators for financial literacy, with TikTok “finfluencers” and YouTube explainers replacing bank brochures and cold-call advisors.

By launching his own platform, MrBeast would cut out the middleman: rather than being paid to endorse someone else’s fintech, he becomes the brand himself.

The timing is strategic. Traditional banks are struggling to engage Gen Z beyond debit-card marketing, while fintech startups face saturation and rising acquisition costs.

A creator with built-in reach — and the trust of hundreds of millions — can dramatically lower those barriers.

What “MrBeast Financial” Might Offer

While the company has yet to make a formal announcement, the trademark and early investor decks outline an ambitious slate of services:

- Mobile banking with debit or credit functionality

- Micro-lending and student loan products tailored to younger borrowers

- Insurance offerings under the same umbrella

- Crypto exchange or wallet integration

- Gamified features, potentially including challenge-based savings or charitable incentives, echoing MrBeast’s content style

If realised, this hybrid approach could turn finance into a social experience — one part savings, one part spectacle.

Industry Reactions and Strategic Implications

Traditional Finance

Banks and regulators are watching closely. If MrBeast Financial succeeds, it could spawn a new wave of creator-led banks built on personality, not brick-and-mortar credibility.

For legacy institutions, that’s both a challenge and a lesson: authenticity now carries measurable economic weight.

The Creator Economy

In the broader creator landscape, this move represents the next stage of monetisation: building proprietary services that extend influence into real-world utilities.

It’s not just about merch or restaurants anymore — it’s about embedding creator identity into everyday life.

Risks Ahead

Regulation will be the defining test. Banking and crypto services require federal oversight, licensing, and strict compliance, which could slow any rollout.

The reputational risk is equally high: any mishap could tarnish a brand built on generosity and trust.

Still, few personalities are better positioned to make such a leap. MrBeast’s reputation for transparency and large-scale philanthropy could become an unexpected asset in selling financial trust to a skeptical generation.

What to Watch Next

- Additional trademark filings or regulatory disclosures confirming specific products.

- The potential fintech partner providing infrastructure (reports suggest he’s seeking collaboration rather than building from scratch).

- Whether MrBeast leverages his existing channels — like YouTube challenges or philanthropic stunts — to promote financial literacy alongside product rollout.

- The reaction of other major creators, some of whom may follow suit with niche-specific “creator banks.”

If it works, “MrBeast Financial” could signal a new era where financial ecosystems are shaped not by institutions but by the personalities people already follow.

MrBeast’s latest venture hints at a fundamental shift in how Gen Z interacts with money — through creators they trust rather than corporations they don’t.

Should “MrBeast Financial” materialize, it could fuse entertainment, education, and economics into one ecosystem, redefining both the influencer economy and the future of fintech.

Sources

- eMarketer – YouTube mega-influencer MrBeast eyes financial services for Gen Z

- Business Insider – Top YouTuber MrBeast is laying the groundwork for a finance venture

- AInvest News – MrBeast’s financial gambit: how influencer-driven fintech is reshaping banking for Gen Z

Influencer Marketing Articles

Actionable tips to get more success with influencer marketing campaigns

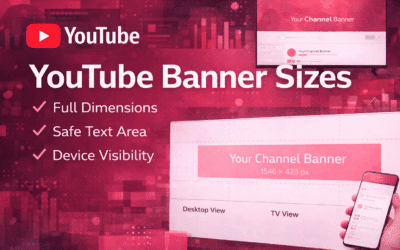

YouTube Video Size – Guide (2026)

The correct YouTube video size is 1920 × 1080 (16:9) for standard videos and 1080 × 1920 for Shorts. This guide includes exact thumbnail dimensions, banner safe area, resolution tables and export settings to avoid compression or cropping issues.

TikTok Aspect Ratio: Complete 2026 Guide

The ideal TikTok aspect ratio is 9:16 with a resolution of 1080 × 1920 pixels. This 2026 guide covers dimensions, safe zones, file size limits, compression tips, and benchmarks to help you optimize video quality and engagement on TikTok.

Best Time to Post on YouTube Shorts in 2026

There is no universal “best time” to post YouTube Shorts.

This guide compares top industry studies, real data numbers, and YouTube Studio insights to show when Shorts gain the most early velocity. You’ll learn how timing influences views and engagement, and how to test posting windows to find the peak hours for your own channel.